Every month for the past 4 years, we have surveyed 1000 UK Adults to find out how they are feeling about the world around them and the month ahead. In these surveys, we learn about things like general mood, and financial confidence. We also include an additional topic, where we ask questions about different specific categories such as pets, healthy eating, exercise, loyalty schemes, meal deals, and so much more.

However, at key points in the year, we also ask people their plans for upcoming festive and cultural moments. So, what does 4 years of insight tell us? And how has COVID, the economy, and wider cultural shifts affected people’s spending and behavioural habits?

Valentine’s Day, Easter, and Halloween

Participation

Valentine’s Day, Easter, and Halloween, cover a broad range of demographics, with participation varying year on year.

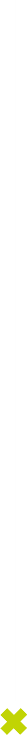

Starting with the month of love, between 2021 and 2024, Valentine’s Day has seen something of a drop off in participation. We can see a peak in 2022 which is likely due to people being released from lockdown and making the most of celebrations. Beyond this jump, we can see a gradual decline over the years, with 2024 seeing a low of just 37%.

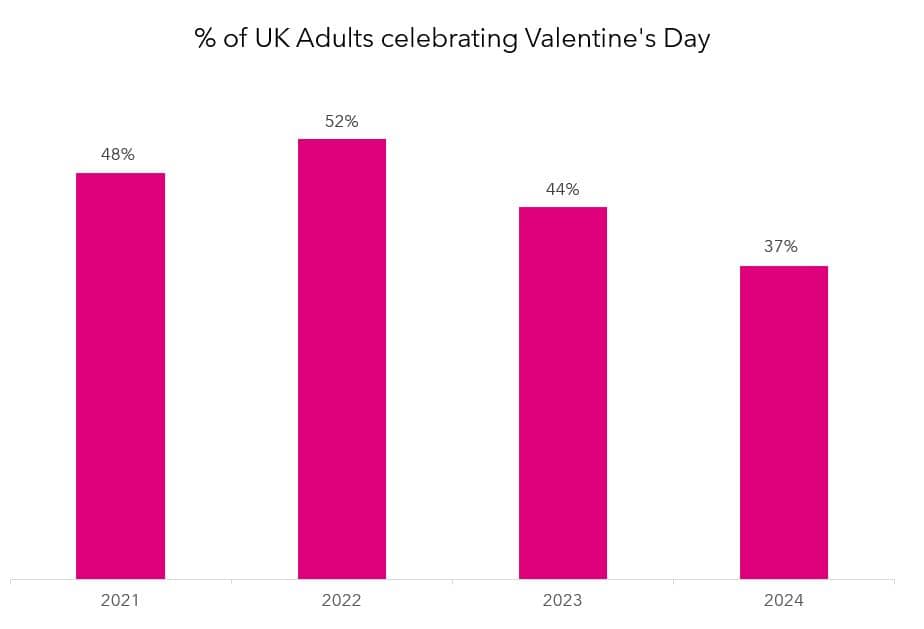

Looking at responses between 2021 and 2023, Easter had a similar peak in 2022, which lines up nicely with the lockdown release theory. Besides that, with only two ‘normal’ years of data, it is tricky to conclude if we are seeing consistent attendance, or even if there is a slight increasing trend. It will be interesting to see the attendance for 2024 in next month’s Mood of The Nation report!

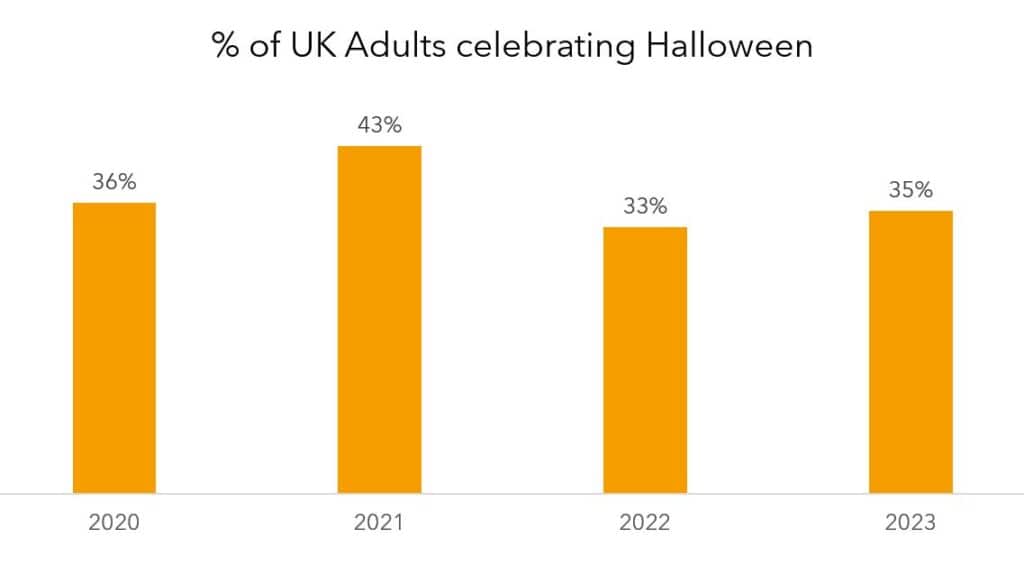

Halloween is consistent, with a slight peak in 2021, also likely due to people being released from COVID restrictions.

Spending

Potentially more interesting would be to look at spending habits across the three cultural moments. Despite steady levels of interest and attendance, and with Valentine’s Day arguably a decline, spending in the top bracket seems to be rising across the board, particularly for 2023.

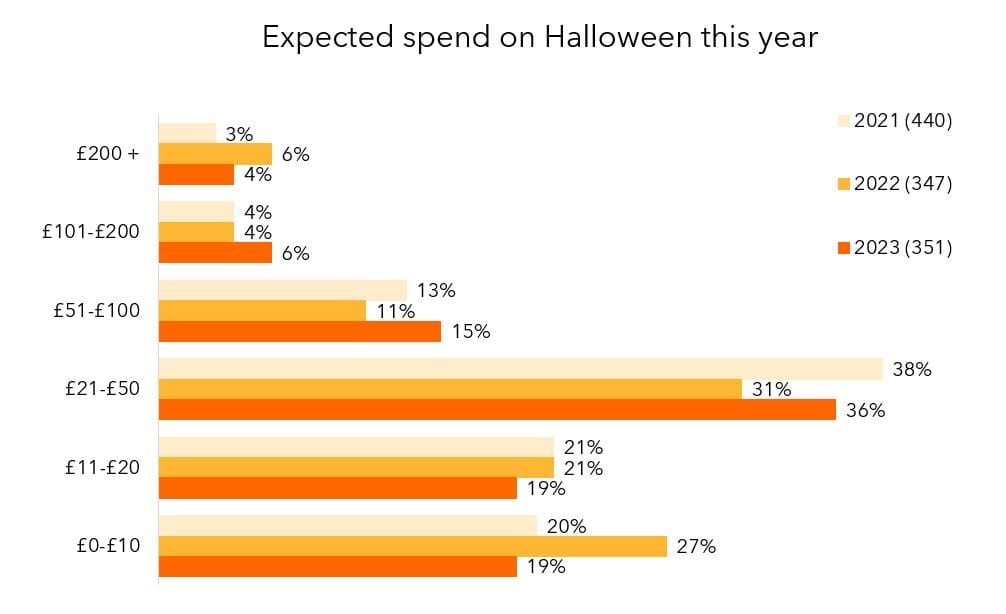

Looking at Halloween, the number of people spending over £50 rose 5% from 2021 – 2023.

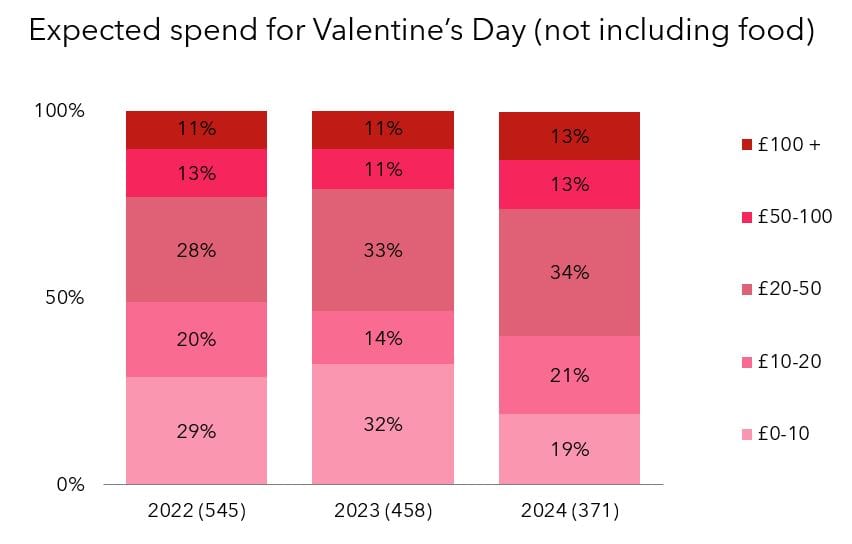

For Valentine’s Day, we see a similar story, with the proportion of people spending over £20 on the day also rising significantly over the last 3 years.

The reasons for these spending increases are likely due to a multitude of factors. For starters, inflationary pressures have meant that we are all paying more for the same amount of stuff. There could also be an element of people spending more during festive moments as a sort of ‘blow out’ after being kept in restricted lockdowns for so long. This is likely coupled with a steady increase in financial confidence over the past year in particular as we’ll explore below.

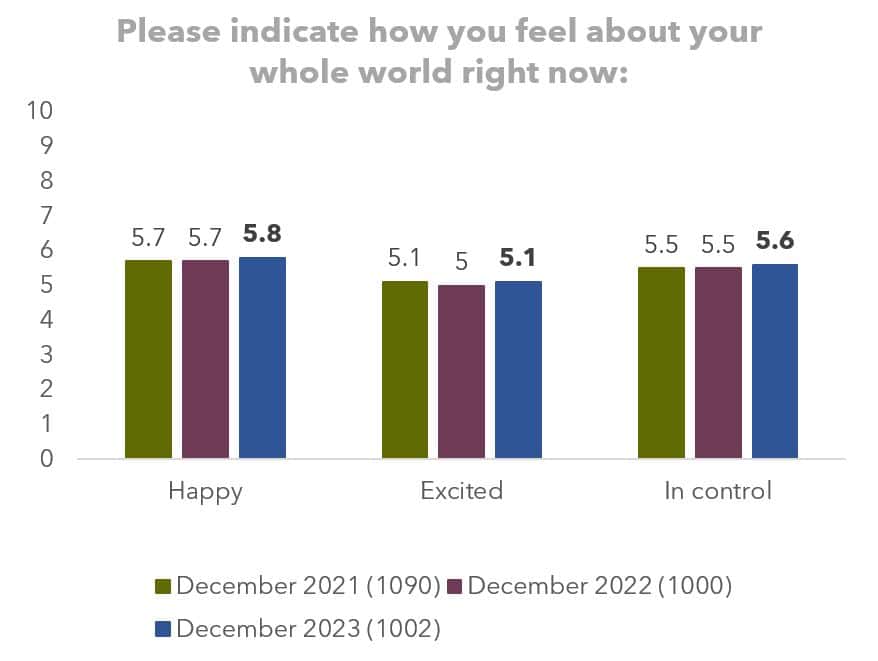

Christmas, Black Friday

Christmas celebration numbers are always strong, with friends and families across the nation gathering together to enjoy the festivities. Looking at people’s levels of excitement, control, and happiness towards the month of December as a whole, we see a relatively consistent and stable level, despite a turbulent external environment over the past 3 years.

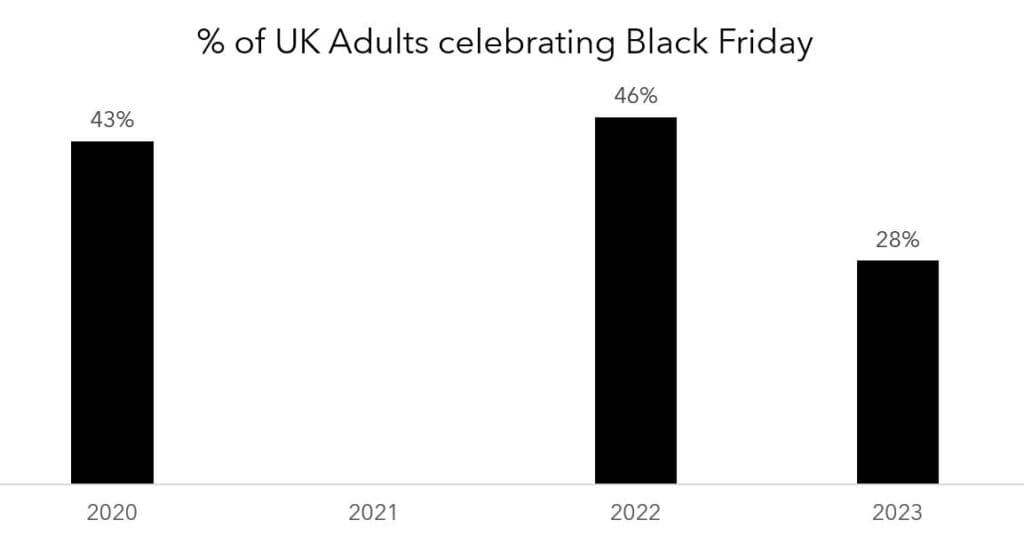

Interestingly when we look at Black Friday, we see a dramatic decline in planned participation levels in 2023 compared to previous years, despite it being one of the most stable external economic environments.

A huge proportion of people cited a lack of credibility in the discounts as a reason for not taking part – could this point to a wider decline in the trading event?

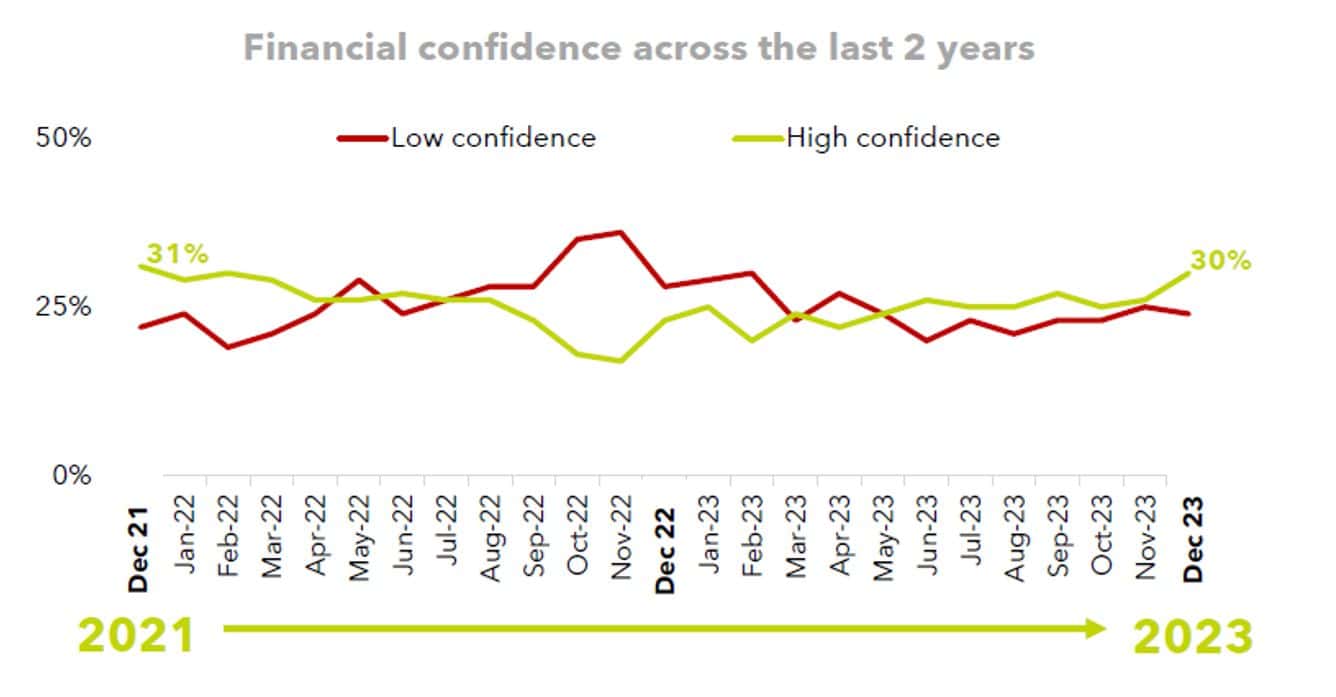

Financial confidence – the macro picture

When we look at financial confidence over the past two years, it is interesting to note that there appears to be a minimal correlation between high financial confidence levels and high participation of cultural moments. For example, if we look at the 2023 Black Friday, where just 28% of people have decided to partake, financial confidence was at one of its highest levels in two years.

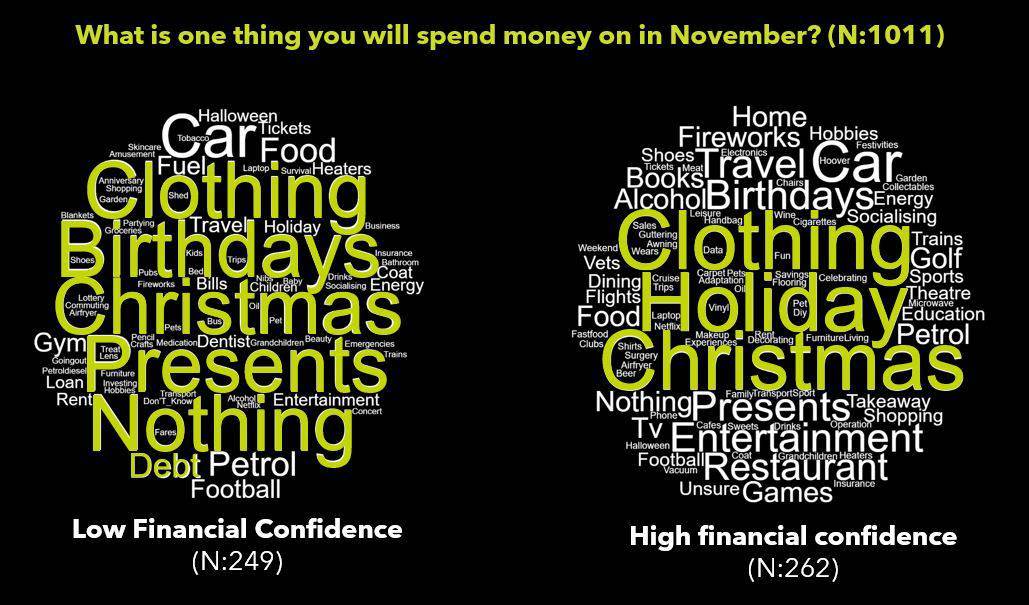

One place where financial confidence does come into play however, is when we look at a breakdown of the mindsets between people with high and low levels of financial confidence and their plans for cultural moments.

Looking at the 2023 build up to Christmas, there are clear nuances between spending plans of those with low and high financial confidence, with things like ‘Nothing’ and ‘Dept’ appearing regularly for those in the former group, whilst ‘Holidays’ were regularly mentioned in the latter.

We can also see this from our recent February 2024 Mood of the Nation, where we found that of the UK adults planning to buy food or gifts this year for Valentine’s Day, 34% had high financial confidence, whilst just 16% had low financial confidence.

Summary

On the whole, most cultural events appear to remain steady in terms of participation, despite a turbulent external environment. Although it will be interesting to see if the decreased participation in Valentine’s Day is a continuing trend.

Nuances in the way people are planning to celebrate exist due to variations in individual levels of financial confidence.

We are also seeing a trend in higher levels of top-level spending, which alongside changing levels of financial confidence, could be attributed to inflation and opportunities to celebrate amid continuous lockdowns.

With external factors likely to mean a turbulent market for a while to come, and with nuances existing between different shoppers, it is imperative to get in-store, OOH, and online shopper marketing right to resonate with your target audience. Think about if you should be highlighting luxury, or value. Bundle deals, or gift baskets.

Get in touch to explore how we can help you understand your customer on a deeper level, through psychology-based research that gets to the true reasons for purchase behaviour.

To receive our monthly Mood of The Nation report, where we continue to survey 1000 UK Adults every month, just fill in the form below.

Other articles you may find interesting

Experiential retail – how retailers are wooing shoppers back to in-store