When analysing data and insight, it’s too easy to focus on what is happening, but it’s a lot harder to see what’s not happening. In the FMCG and shopper worlds, data is dominated by buyers. Who they are, what they do, if they match the target consumer, and how they consume. But data on those who leave the shelf empty-handed are far harder to come by…

For those that haven’t looked into non-buyers, it’s probably because you’ve assumed that most people that visit the shelf leave with something. I mean, why would you dedicate the time to standing in the aisle for more than a minute, only to decide you don’t need what you’ve been spending all that time looking at?

But as we know, we as human beings are irrational creatures. To an outsider (or a Spark Emotions researcher), our behaviour looks very illogical, and no more so than when we’re shopping!

1 in 5 shoppers engage but don’t buy

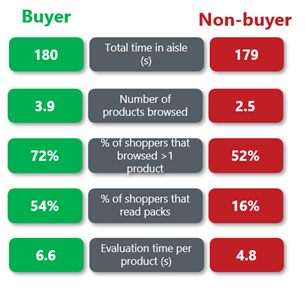

If we look at the numbers, our observational data shows that for an average category in an average supermarket, as many as 20% of shoppers who engage (visually, but more than a glance) with the category will walk away without purchase. To labour the point, that’s 1 in 5 shoppers leaving without a purchase despite putting the effort in to shopping it. It’s important to note that these non-buyers aren’t just glancers, or that they’re spending a few seconds looking then walking away; these people spend just as much, if not more time in the category. In the below example from the healthcare category, you can see this in action.

Of course, there are some places you’d expect people to walk away. For instance, just 20% of Beauty shoppers end up purchasing in your typical out of town or High-street store. In Toys and Games, it’s as low as 16%. Of course, some shoppers have to purchase when they shop. 97% of Milk shoppers will go on to buy in Convenience (but even in milk there is some walk away!), and Food to Go drinks is as high as 94%.

Small percentages make a big difference

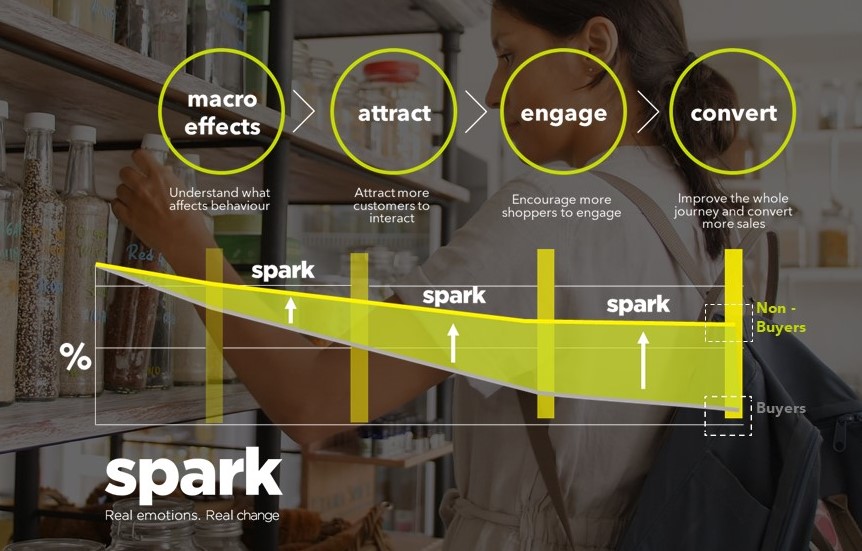

Each extra % of shoppers you manage to convert means millions of added dollars/pounds/euros across the estate, demonstrated below on our shopper funnel. The key to unlocking this opportunity is understanding your non-buyers.

Because whilst these numbers may seem startling from a category perspective, they can be even more surprising when looking to brand-level detail. Whilst a shopper may ultimately leave the category with something, they will have de-selected several brands along the way, meaning some brands on shelf may have single-digit (or less) conversion rates.

How can we help

Just as there are category differences in conversion to purchase, there are key differences in the barriers which drive this behaviour across categories and formats. It could be confusion, lack of knowledge, navigation issues, price sensitivity etc. The only way to find out is by researching this group of people to understand what the barriers to purchase are.

At Spark Emotions, we are experts at understanding shopper behaviour, our team of consumer psychologists and industry leaders are able to generate actionable insights that will help you grow your business.

Get in touch with us by entering your details below

Written by Will Morgan, Associate Director at Spark Emotions

If you have any questions, feel free to reach out to Will via email will.morgan@sparkemotions.com or connect on LinkedIn