The COVID-19 pandemic has had a well-documented impact on the UK economy, in June it was reported than more than a quarter of the UK workforce (8.9 million) were being supported by the UK Government’s furlough scheme. The cost of the scheme is currently estimated to be around £25.5 billion, this alongside the guaranteed loans that have been given to business, all created nervousness in the UK public.

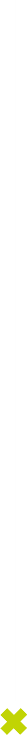

When we spoke to 1,000 people in our UK survey back in June, some significant events were going on, one of which was the ONS reporting the UK economy has shrunk by 20.4%. This is important because it would have had a significant effect on how people were feeling when they participated in our survey.

How are UK adults going to be spending in July

We wanted to understand how the UK was going to be spending in July as non-essential retail shops started to open. We’ve already seen Dave Lewis at Tesco talking about how customers are going back to the weekly shop, therefore visiting the supermarket less often, but spending more on each visit. It has actually been reported that UK retail sales have grown in June, showing confidence is coming back to UK shoppers.

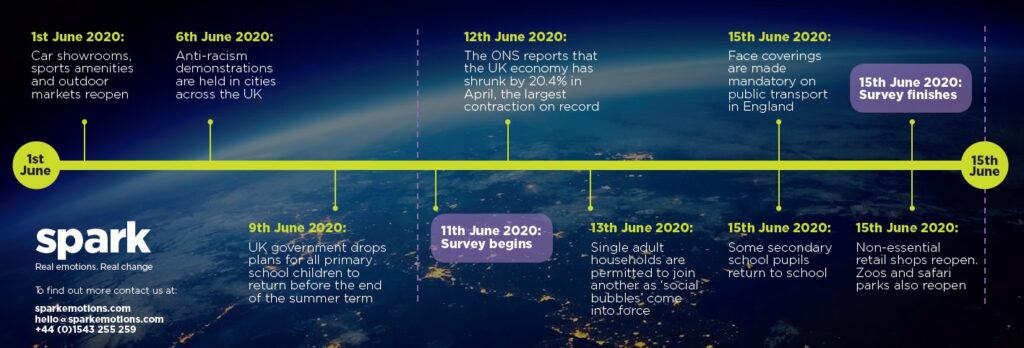

Moving into July, our research told us that the majority of UK adults (60%) intended to spend less in July 2020 than they did in 2019. All of the uncertainty within the economy and the job market will have certainly fuelled this behaviour and with the UK public paying back £7.4bn of debt in April we can see people are planning for the downturn. We only saw 10% of UK adults expecting to be spending more than last year and only 30% expecting to be spending the same amount, which highlights significantly less money in the marketplace to be capitalised on, putting massive pressure on businesses to really understand their customers to win market share.

Unsurprisingly, we found the impact on spending in July for people who had been, or are currently furloughed is even more pronounced, with 65% expecting to spend less money.

How does the UK public feel about their financial situation in July

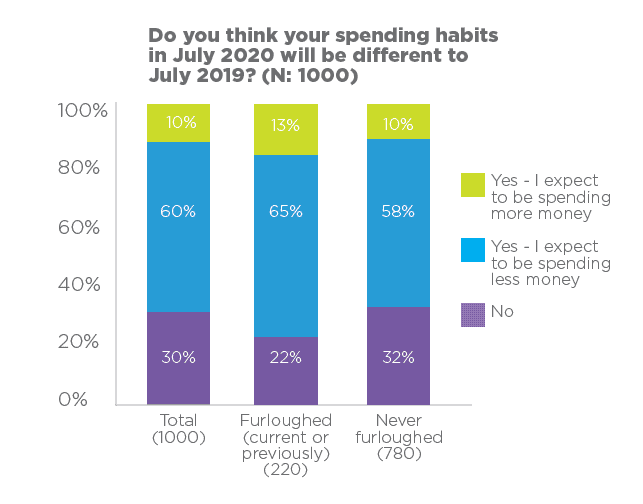

When we asked UK adults how they felt about their finances we received some really interesting results depending on their work situation. Adults who are currently furloughed, or were previously, predominantly used the word “Worried” to describe their financial situation, whilst those who haven’t been furloughed described their situation as “Stable”.

The level of concern with adults who have been, or currently are, furloughed is quite staggering and with reports of many people not having more than a months salary in savings, this will really impact how these people will be able to go out and spend money.

People with less savings are really concerned

During our research, we also wanted to understand how much of a difference savings made to how people were feeling. We found that that 60% of people expected to save differently, with 40% expecting to save more and 20% to save less. This tells us that people who are in a stable financial situation are looking to create more of a buffer to be prepared for a downturn, whilst those whose finances are already stretched aren’t able to save anything. Unsurprisingly, this creates a lot of concern for people in that situation. We broke down our respondents by socio-economic class to understand this better, and our hypothesis was backed up. Those who are categorised as C2DE had predominantly negative feelings, and the keyword that was used to describe their situation was “Worried”, compare this to those categorised as ABC1, who described their situation as “Stable”.

Summary

Now more than ever, it’s crucial to understand who your customers are, how they feel and how they behave. By understanding this, businesses will be able to align their products and services to reflect their customer’s financial situation.

By doing this, businesses will be able to build brand affinity, advocacy and drive sales.

Written by Jack Hillaby, Head of Business Development at Spark Emotions

If you have any questions, feel free to reach out to Jack via email jack.hillaby@sparkemotions.com or connect with him on LinkedIn